Integrated instant issuance: the advanced solution for in-branch card printing.

The in-branch instant issuance of bank cards is becoming increasingly popular. There are different solutions that allow setting up this type of service.

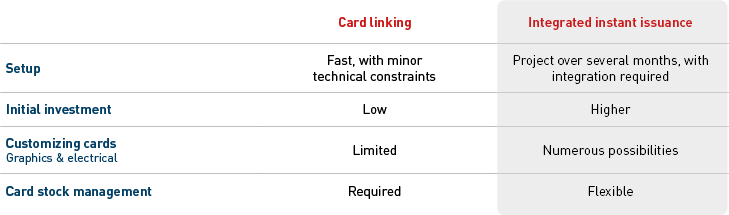

Some of them, like card linking, are very easy to deploy but are limited to the customization of some personal data (for more details see our article on card linking).

Other, so-called “integrated” solutions, offer almost infinite possibilities for graphic and electrical customization. They go further in terms of security and service automation but require more integration.

This article focusses on these integrated solutions that offer “ultra-personalization”. How do they work? And how are they different from card linking? What are their main advantages?

Integrated instant issuance of cards in-branch: how does it work?

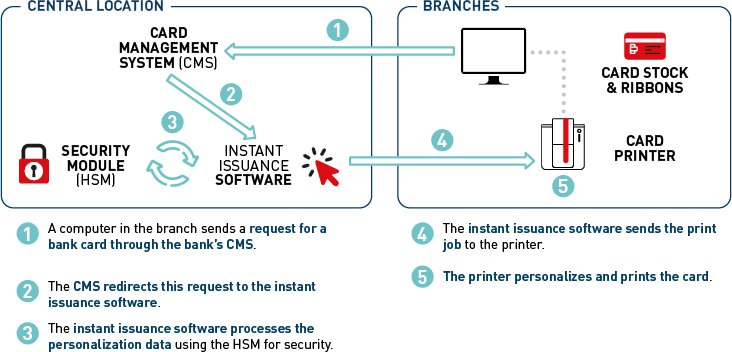

Deploying an integrated instant card issuing solution requires a complete installation with hardware and software in the bank. Some of the required elements (equipment, software…) must be installed centrally, while others have to be on-site, at every branch.

Required items:

- Card printers: installed in every branch, they print the bank card and personalize it graphically (design, personal data, etc.) and electrically (magnetic stripe encoding, contact chip, contactless chip). The instantly issued bank card is then given to its holder who can use it immediately.

- Cards and ribbons: a stock of blank or pre-customized cards and ribbons must be available in each agency to keep the printers supplied.

- Instant issuance software: this is installed in a central location and accessible from each branch. When a request for a card is made from the bank’s CMS (Card Management System), it is immediately redirected to the instant issuance software. The software then prepares the personalization data and sends the print job to the printer.

- Security Module (HSM): the instant issuance software relies on this module to securely prepare the data needed to personalize the card.

This type of solution is optimally integrated with the bank’s system. Thus, all the steps required for this process are automated.

The major benefits of an integrated instant bank card issuance solution in-branch.

The instant delivery of bank cards to customers can be achieved in different ways. Card linking is one of these other solutions. So what are the differences between an integrated instant issuance and personalization solution compared to card linking?

Integrated instant issuance vs. Card linking.

Great design possibilities.

Infinite possibilities for more precision! This is made possible by the ability to print on completely blank cards. That means no restrictions when it comes to design. You can even create unique cards for each customer, by integrating personalized elements such as a photo. This personalization service is a way for a bank to differentiate itself from its competitors, to enhance its brand image—and thus generate more revenue.

On the other hand, card linking is based on the use of cards whose personalization is limited, at most, to the name and surname of the future holder.

Optimal safety.

The security of their customers’ personal data is paramount for banks. That’s why the integrated instant card issuing and personalization solutions are based on card network security recommendations and security standards (PCI-DSS) to ensure that any sensitive data cannot be compromised during the card issuing process. This includes the implementation of cryptography or advanced security options on the printer (locking the device, automatic deletion of data printed on the ribbon, etc.).

A process offering a high level of efficiency.

The process of an integrated solution is fully automated (as opposed to card linking which requires manually linking the issued card to the right person and with the right associated services). This saves time and reduces handling errors, since no manual operation is required.

There are also cost savings thanks to better management of card stocks.

Indeed, while card linking requires managing a stock of cards whose expiration date is already in place, integrated instant issuance does not suffer from this constraint since it personalizes the date at the time of issuance. This is also an advantage for the customer, who gets a card with an expiry date from the day it is issued (and not one that has already passed).

Here are some tips on what to get.

There are many options to choose from if you are looking for an integrated solution for instant issuance and personalization of bank cards. Here are our tips to help you find your ideal card printer and software solution.

The card printer.

The card printer is the central element of the system. To choose the right model, we advise you to pay special attention to its reliability, ergonomics, safety level, durability and compatibility.

Details on the criteria that you should consider can be found in our free white paper “Instant card issuance: advantages & solutions”.

The software.

The software solution is an equally important element. Our recommendations:

- Choose a software solution that is compatible with as many card printers as possible: make sure the software solution is compatible with as many card printers as possible. That way you have the freedom to choose the model that suits you best.

- Ensure the automated integration of the software solution is compatible with various card management systems, and more specifically with your bank’s.

- Go for a software solution with a remote supervision functionality: this allows monitoring the level and the stock of consumables (cards, ribbons) and to automate their replenishment in the agencies. This feature allows for perfect service continuity.

System integration.

The card printer and the software solution you choose must work hand-in-hand. This requires system integration, which is most commonly assured through a partnership between the card printer manufacturer and the system integrator. This collaboration is essential to the success of your project. So you need to make sure that your card printer supplier has the necessary competencies.