First-half 2018 revenue

Angers, 17 September 2018 – Evolis, world leader in plastic card customisation and printing solutions, announced its revenue and results for first-half 2018, ended 30 June 2018.

First-half 2018 revenue ended at €38.0m, down 6.4%. At constant exchange rates, business was stable (-0.7%).

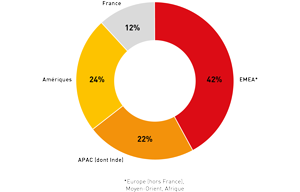

The Channels business line ended at €26.8m (-0.4% at current exchange rates). At constant exchange rates, Channels grew 4.8%. All the Group’s regions grew, except the United States, where teams are ramping-up, and the Middle East. In Europe, Channels was driven by long-standing networks and growth in sales from Edikio food labelling solutions. In Asia, new distribution agreements signed in China and the first effects of restructuring in India are adding further momentum..

The Projects business line reported revenue of €9.0m, down 21.7%, i.e. -13.9% at constant exchange rates. Aside from the significant impact in exchange rates, this change is mainly owing to the suspension of the Aadhaar government project in India, in addition to the postponement of projects in the Middle East and Latin America. Second-half 2018 will be more favourable for this business line, driven by projects that have already been signed: government contract in India and contract for the Edikio range with a major food retailer in Germany.

Results impacted by a decline in activity and a one-off provision

At end-June, the gross margin rate remained stable at 61.8% versus 62.1% at end-June 2017. The slight 0.3-point decrease is entirely owing to a change in exchange rates. Production costs were thus kept under control.

Operating profit at end-June came out at €4.1m. Over the half-year, Evolis had to deal with one of its distributor clients defaulting. The distributor’s debts were earmarked, impacting operating profit by €0.5m. Restated for this one-off item, operating margin ended at 12.1% versus 16.8% in first-half 2017. The margin was penalised by a decline in activity, despite tighter control over operations.

After taking into account financial income that benefitted from a positive exchange rate impact and a decrease in income tax expenses, net income ended at €3.0m at 30 June 2018.

2018 target revised and 2020 target confirmed

Evolis is working on large-scale government and banking projects where agreements can be postponed. Since its first-quarter 2018 revenue release, the Group has been impacted by a slightly weaker than expected recovery in its Channels business line in the United States, and by further postponements mainly in Latin America and the Middle East, owing to an unfavourable geopolitical environment. In light of these factors, Evolis is now targeting growth in 2018 revenue of 3% (based on a euro/US dollar exchange rate of 1.20), versus 6% growth previously stated. Based on this level of activity, the Group expects an operating margin at end-2018 slightly above that of end-June excluding one-off provisions.

Following a period of lower growth, Evolis expects to return to good growth momentum as of second-half 2018. Evolis is confirming its target for revenue of €100m in 2020.