Annual earnings 2016

Angers, 21 March 2016 – Evolis, world leader in plastic card customisation solutions, is announcing its earnings for FY 2016 approved by its board of directors on 16 March 2017.

| In M€ | 2016 | 2015 | Change |

| Sales | 76,9 | 76,7 | +0,3% |

| Operating income | 13,6 | 14,8 | -8,3% |

| Op. margin in % of sales | 17,7% | 19,3% | -1,6pts |

| Financial income | 0,5 | 0,5 | 0% |

| Income tax | -4,7 | -5,0 | -6,0% |

| Net earnings | 9,4 | 10,3 | -8,7% |

| Net margin in % of sales | 12,2% | 13,4% | -1,2pts |

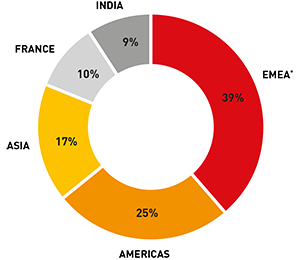

2016 sales globally stable with significant business growth in China and India

Evolis’ FY 2016 consolidated sales are up +0.3% vs. 2015 in line with the forecasts.

- The Channels business is up 10.5%, driven notably by high growth in India (+50.7%) and Asia (+14.9%). The Americas show slight negative growth of 1%, with a slump in the ID business almost compensated by the IT Office business, which has achieved 37% growth in the area.

- The Projects business remains stable despite an adverse base effect (Tanzania M€ 4.8 contract in 2015) and the postponement of some major projects in 2016. This line is still being driven by the US banking market representing 26% of Projects turnover, and the development of the Projects business in China during the second half.

- Two geographical areas stood out in these two business lines in 2016: India (+30.6%) and China (+89%). The share in turnover of these two countries has significantly grown from 11.6% of global sales in 2015 to 18.0% in 2016.

2016 earnings: a year of transition.

Gross margin for 2016 remains excellent at 59.6% (vs. 59.1% in 2015) of turnover due to a change in the networks/projects mix. During this structuring and development phase, the operating margin has declined 1.6 pts to 17.7%, in line with the group’s expectations.

Net earnings remain healthy at 12.2 %, with a slight decline of 1.2 pts.

In this context, self-financing capacity is sound and has attained a level of M€ 12.6. Net cash flow remains stable (M€ 24.9), despite an increase in investments and payment of an extraordinary dividend.

Sales growth prospects for 2017 on the order of 5%

After a year of transition, 2017 will be a year of structuring (opening in Tokyo, structural reorganisation on the American continent, the recruitment of a senior manager) aimed at putting the group back on the track to growth in sales on the order of 5% in consolidated data.

Proposed dividend of € 1.20 per share

Because earnings and cash flow was maintained in 2016, and in view of a very sound and unleveraged financial structure, the Group has decided to submit the payment of a € 1.20 dividend to the approval of the shareholders general meeting on 4 May next.

Strengthening the executive management team

To support Evolis’ development and in view of the group’s maturity, Evolis has decided to recruit a senior manager. Christian Lefort will be in charge of adapting and implementing the group’s strategy beginning on 03 April 2017.

54 year old Christian Lefort, of French-German birth, holds a graduate degree from the Institut Supérieur de Gestion and has acquired 27 years of experience with the Armor SA group in Nantes and with the American group Dover Corporate in the sales & marketing division of its subsidiary Markem-Imaje in Valence, before becoming CEO of its subsidiary Datamax-O’Neil in the United States, followed by Dirickx in Mayenne. Armed with experience as an international business developer, Christian Lefort has built his expertise on his ability to implement strategic sales plans and his know-how in production management and distribution channel development both in France and internationally.